Forisk tracks domestic and export log prices in the Pacific Northwest as part of the Forisk Wood Fiber Review (WFR) research program, which reports on pulpwood, chip, and fiber prices for major regions in North America. Unlike timber prices in the U.S. South, which are typically reported on a stumpage basis and do not include the cost of logging and hauling, log prices in the Northwest are typically quoted on a “delivered” at-the-mill basis. This reality has implications for how investors, forest owners, and analysts use this type of information when valuing timberlands.

Delivered versus Stumpage

The distinction between stumpage and delivered meets different needs. In the U.S. South, prices reported as stumpage (timber “on the stump” or a tree value “per stump”) can feed directly into timberland valuations and appraisals. The cash flow from harvesting per acre is the volume per product times the stumpage value of that product. However, wood-using mills must add on logging and hauling estimates to develop their raw material budgets for wood procurement and capital investments. For mills, their raw material costs are a function of delivered logs “at the gate” and everything required to get them there.

In the Pacific Northwest, delivered prices speak in the “language of mills” while timberland owners and appraisers must subtract estimates of logging and hauling to get a better understanding of the net timber revenues going to the landowner. The norm for reporting prices in the Northwest, as compared with the South, is in reverse, and that’s before we even account for the different species and units (e.g. board feet versus tons).

Update on Delivered Log Prices

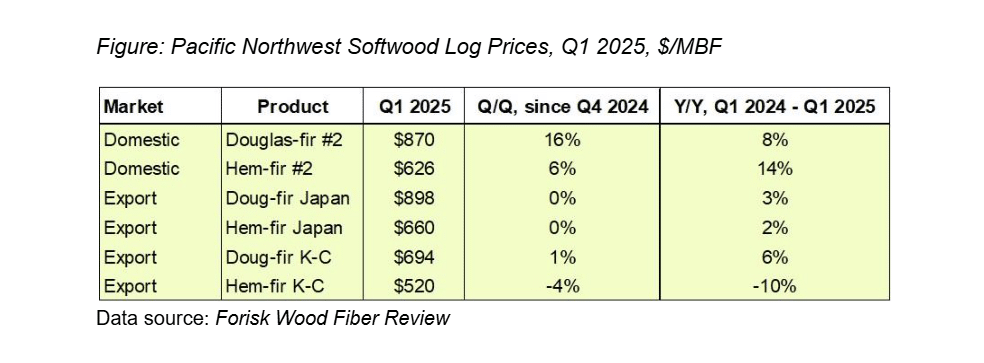

Reporting from the Wood Fiber Review on Northwest softwood log prices reinforces these regional differences in timber markets. Delivered prices for #2 Douglas-fir logs in early 2025 showed meaningful upward movement, increasing 16% in Q1 2025, and 8% year-over-year (Figure). “Pretty good markets,” said one log seller. “Log prices have been coming up on the domestic side since November (2024) in Oregon and more recently in Washington.” At the time, several managers spoke to how they saw domestic log pricing as “disconnected from the fundamentals” and “driven by fear” over policy.

More recently during Q2 2025, delivered prices for #2 Douglas-fir logs remained stable after the sharp climb in Q1 quarter. In talking with sawmill log buyers, they noted the strong competition for logs, but the continued disconnect with lower softwood lumber prices. That said, prices small logs (chip-n-saw) and white woods did soften.

More broadly, regional log consumers continue to manage real constraints. Sawmillers in the Northwest “struggled to find people” to fill second shifts, and labor issues were a theme related to logging and forest management activities. While domestic prices surged, the export market is “in a doldrums”, especially for the China log sort, a casualty of current trade and tariff policies.

This content may not be used or reproduced in any manner whatsoever, in part or in whole, without written permission of LANDTHINK. Use of this content without permission is a violation of federal copyright law. The articles, posts, comments, opinions and information provided by LANDTHINK are for informational and research purposes only and DOES NOT substitute or coincide with the advice of an attorney, accountant, real estate broker or any other licensed real estate professional. LANDTHINK strongly advises visitors and readers to seek their own professional guidance and advice related to buying, investing in or selling real estate.

Add Comment