Pulpwood, the smaller trees typically chipped for making wood pulp, oriented strand board (OSB) or wood pellets, provides balance and diversification to the forest products industry. Robust, sustainable timber markets feature a broad set of wood consumers for the range of timber products grown by forest owners. A local wood basin with no demand for pulpwood or chips is like a shoe box with one shoe: incomplete.

While roundwood deliveries satisfy most pulpwood demand across the U.S., this varies by region and mill type. In the South, chip mills supply close to 20% of total pulpwood demand. In the West, they supply close to 30% of fiber needs, though total volumes are lower given that fewer pulp mills operate in the region. According to the Wood Fiber Review, the actual supply profile of each region in North America varies based on pricing and market demand. Forisk mill-by-mill research of wood-consuming capacity suggests close to 60% of pulp mill wood-using demand in the U.S. is met by roundwood.

Pulpwood Drivers of Demand

Wood fiber costs account for over 50% of the total pulp manufacturing cost worldwide. In North America, demand for pulpwood derives from three primary sources. One, forest industry consumers such as pulp mills and OSB plants. Two, wood bioenergy projects use pulpwood to produce pellets and electricity. Three, pulpwood demand associated with liquid biofuels capacity is increasingly in the news, especially with growing interest in sustainable aviation fuels (SAF).

Wood pellets have been a noteworthy source of growth. Wood pellet capacity reached 20 million metric tons in North America in 2021 and is forecasted to reach 23 million metric tons in 2022. Much of the growth is in the U.S. South, within economic freight distance of ports. Canadian wood pellet capacity projects to increase 13% in 2022.

Pulpwood Supplies and the U.S. South

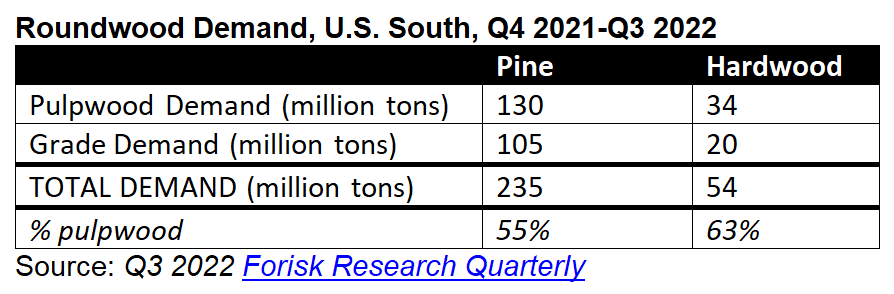

When digging deep into pine pulpwood supplies in the U.S. South, the most important characteristic for short- and medium-term projections is the age class distribution of the pine plantations (inventories) that drive industrial forest management in the region. In the U.S. South, wood-using mills consume more pulpwood than grade (table). For pine pulpwood demand across 11 states, quarterly rankings in the Forisk Research Quarterly highlight Georgia, Alabama, and Louisiana as the three biggest consumers in the region.

When “scoring” markets for projects that require pulpwood supplies, investors prefer those that feature abundant supplies (both standing and from mill residuals), limited competition, lower prices, and sufficient logging capacity. On a relative basis across regions, this helps explain the attractiveness of the U.S. South for pulpwood-using facilities.

This content may not be used or reproduced in any manner whatsoever, in part or in whole, without written permission of LANDTHINK. Use of this content without permission is a violation of federal copyright law. The articles, posts, comments, opinions and information provided by LANDTHINK are for informational and research purposes only and DOES NOT substitute or coincide with the advice of an attorney, accountant, real estate broker or any other licensed real estate professional. LANDTHINK strongly advises visitors and readers to seek their own professional guidance and advice related to buying, investing in or selling real estate.

Add Comment