According to The Economist (“Private equity may be headed for a fall,” July 7th, 2022), “Private equity benefits from a fig leaf of illiquidity,” which covers up for delays when valuing investment assets and hides their true volatility. The inability to confirm value in real-time or robustly quantify risk sounds, to me, like walking a tightrope in the dark (don’t try this at home), where we don’t know how far we are above the ground at any given moment.

As a forest industry analyst, I follow private equity markets because they have and do play a role in the buying and selling of manufacturing facilities, and they also describe fundamental financing mechanisms for institutional timberlands. Each year at our annual conference, when we share research on forest industry investments, we address the relevance and irrelevance of new information to timber markets and wood-dependent businesses. That means, when considering broader issues in, for example, private equity, I think about their relevance to timberland.

Relevance to Timberlands

Interest rates are rising. This affects borrowing costs and home values. Yet, many macro and industry-specific fundamentals continue to favor the forest industry: demographic trends, an aging and underbuilt housing stock (new homes needed!), and strong employment (people have jobs and savings). The overbuilding of homes and rabid mortgaging that fronted the 2007-2009 Great Recession differ materially from the situation today, where corporate debt is at or near record levels. U.S. corporate debt levels and the growth of private equity, which tripled its capital over the past 15 years, comprise a round mound of obligations.

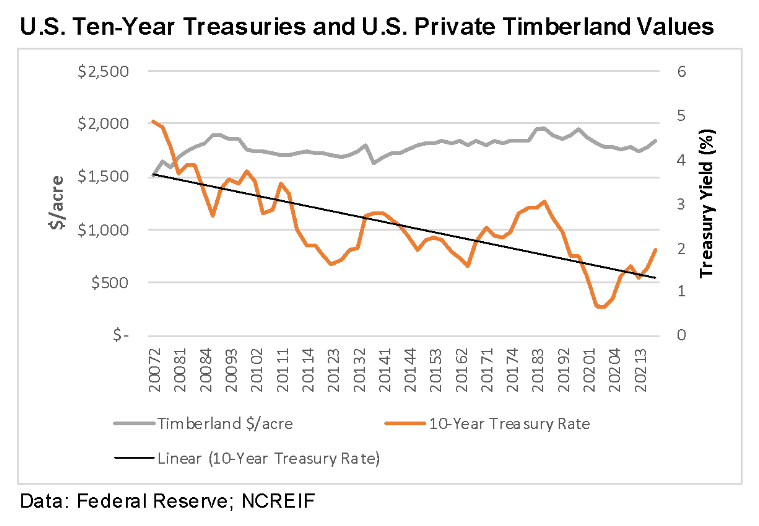

Timberland investments require a useful view of value and risk. Interest rates, through discount rates and the “market for money,” affect timberland valuations and expectations. However, the relationship over the past fifteen years between interest rates and average timberland values raises questions (figure). While, on average, 10-year U.S. Treasuries yields fell more than 50%, average private institutional timberland values in the U.S. increased more than 20% (with most of that increase occurring in 2007 and 2008, and values remaining plus/minus flat the past 12-13 years).

Buying or rehabilitating riskier assets (the private equity specialty) or paying higher prices for reliable ones (observed with timber), ultimately pushes returns lower. While reaching for assets may provide good value relative to bonds when interest rates are low, they can also grow risk within a portfolio, especially as interest rates rise. There is a pecking order for investment opportunities, where public and private equity returns should outperform bonds by suitable margins to account for the relative risk.

The “illiquidity” pinned to private equity actually serves as a protective moat in the world of timberland investing. Still, we need clear asset and firm values to understand true default risk. Loan-to-value means you know the loan amount and the asset value. When folks load up on debt, they create a situation that must, ultimately, be unwound, so we want to be sensitive to this as the exposure extends beyond the individual firm.

This content may not be used or reproduced in any manner whatsoever, in part or in whole, without written permission of LANDTHINK. Use of this content without permission is a violation of federal copyright law. The articles, posts, comments, opinions and information provided by LANDTHINK are for informational and research purposes only and DOES NOT substitute or coincide with the advice of an attorney, accountant, real estate broker or any other licensed real estate professional. LANDTHINK strongly advises visitors and readers to seek their own professional guidance and advice related to buying, investing in or selling real estate.

Add Comment